Learn more about the benefits options available to you at Freese and Nichols and the highlights of our plan.

Welcome to Benefits Enrollment!

Use this page to learn more about our offerings, get links to resources and more.

If you haven’t already, download the MyPerks app to help track your benefits. Ready to enroll now? Get started here:

Enroll here

Highlights for 2026

What’s Changing

- The Buy-Up PPO medical plan is frozen. This means that new plan participants will not be eligible to enroll in the Buy-Up plan. For those that are currently enrolled, they will be able to stay in the Buy-Up Plan for 2026 only. The plan will completely discontinue in 2027.

- BCBS will be changing their family and women’s health solution from Ovia to a new company called Maven Clinic. Maven Clinic brings expanded capabilities and a broader suite of services, including 24/7/365 virtual access to 30+ clinical and care support specialties.

- The IRS contribution limit for the Dependent Care FSA will increase in 2026 to $7,500 (if filing jointly).

- The IRS contribution limit for the Healthcare FSA will increase in 2026 to $3,400

What's the Same

- BlueCross BlueShield will continue to provide our medical coverage.

- There will be no changes in coverage for the following: Dental, vision, basic life and AD&D, voluntary life, hospital indemnity, short term medical leave, long term disability, accident and critical illness insurance.

- IDShield and LegalShield will continue to provide identity protection and access to legal aid.

- All benefits-eligible employees will continue to have access to Keeper Security, a password locker for personal and professional use.

- Nationwide will continue to provide pet insurance.

- WEX will continue to manage our FSA/HSA accounts.

- The MMA Service center is still available for employees needing assistance with claims or benefits questions.

- Nayya is also available to help you navigate the benefits decision-making process.

What’s New

- Beginning in 2026, employees covering dependents on their medical, dental, and/or vision plans will be required to supply documentation that verifies the dependent’s relationship to the employee.

- Look out for more information about the dependent audit process from Alight in January 2026.

- We are excited to announce that employees eligible to participate in the medical plan will have access to the new wellness app, HealthCheck360! HealthCheck360 provides you with tools, motivation, and support to assist you in your journey to a healthier you.

- If you complete specific tasks by 11/21/25, you can earn a wellness incentive in 2026!

Medical, Dental and Vision

Medical

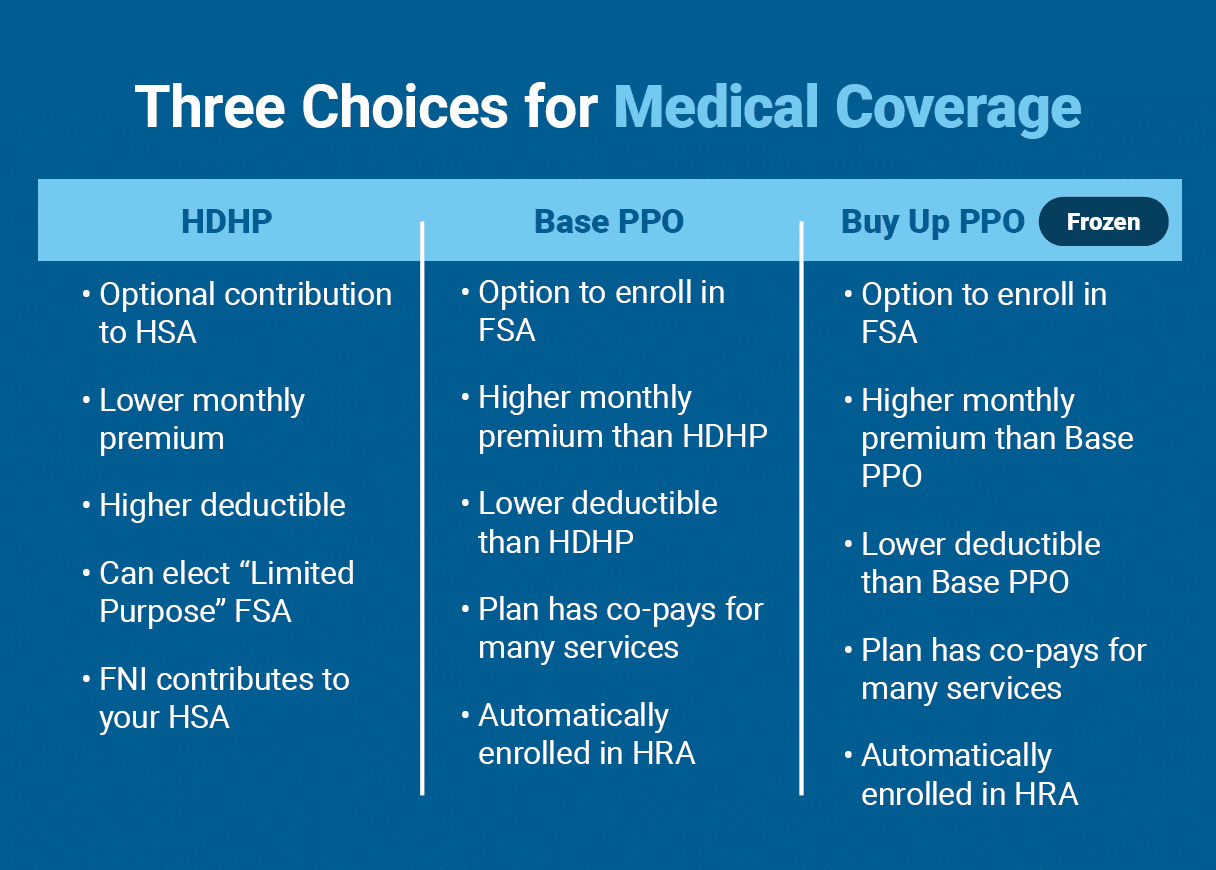

We partner with Blue Cross Blue Shield (BCBS) to administrator our medical plans. You can choose between three medical plan options:

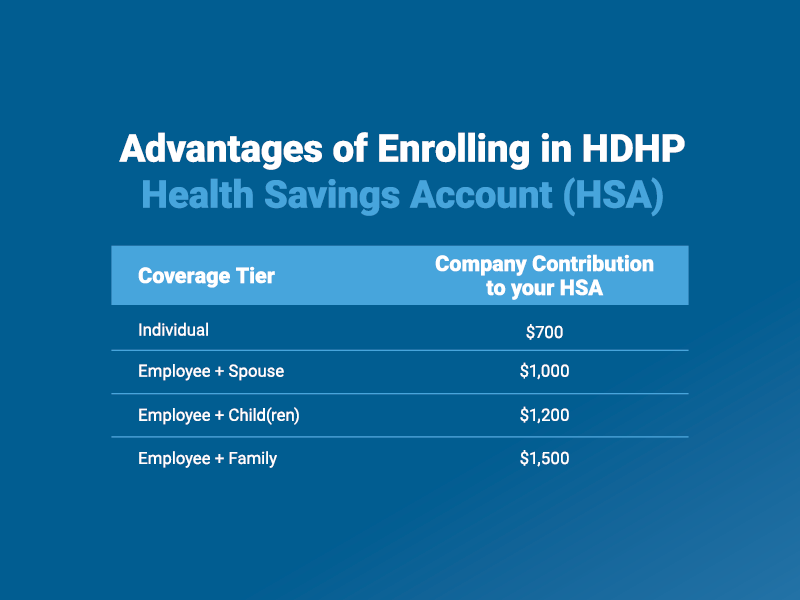

- High Deductible Health Plan (HDHP) with Health Savings Account (HSA)

- Base PPO with Health Reimbursement Account (HRA)

- Buy Up PPO with HRA (FROZEN)

After you have met your deductible on the HDHP, non-preventative expenses will be covered by the plan at 100% in-network.

Dental

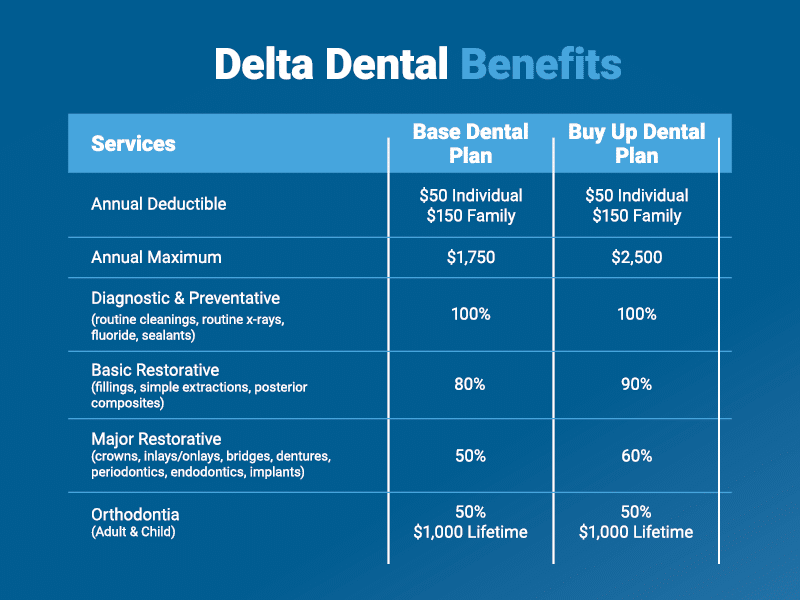

Dental insurance is provided by Delta Dental and offers two plans:

- Dental Base plan

- Dental Buy Up plan

Vision

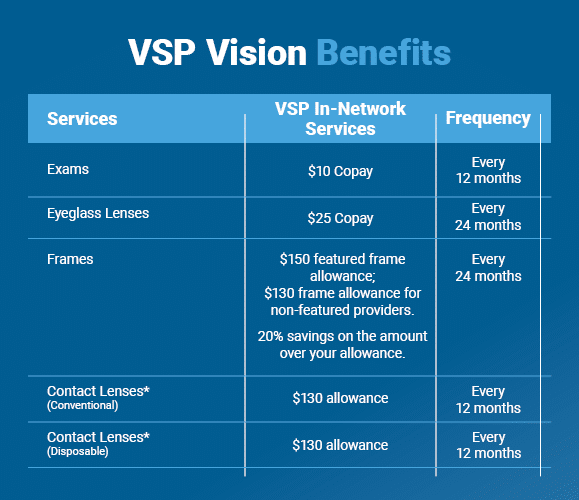

Vision insurance is provided by VSP.

Medical, Dental and Vision Resources

Here are a few resources for making the most of your plans. If you would like to talk through your options, phone numbers are listed for each carrier below.

Find in-network medical doctors and facilities

Are your providers in the BCBS network? Click below to search the Blue Choice PPO network, or call Blue Cross Blue Shield at 800-521-2227.

SEARCH BCBS NETWORKMedical Mobile App

Download the BCBS mobile app for your smartphone and have your medical benefits with you wherever you go. You’ll also have access to your medical digital ID card with a tap of a finger.

DOWNLOAD BCBS APPFind in-network dentists

Click below to search the Delta Dental network, or call Delta Dental at 800-521-2651.

SEARCH DELTA NETWORKFind in-network vision providers

Click below to search the VSP network (filter by network for “VSP Advantage”) or, call VSP at 800-877-7195.

SEARCH VSP NETWORKBenefits of the High Deductible Health Plan (HDHP)

Enrolling in HDHP? Gain a Health Savings Account

Don’t let the words “high deductible” scare you. This is a good time to understand how much you use the health plan — and consider when the last time was that you met your deductible. There are advantages of enrolling in the plan, including the Health Savings Account (HSA). This account is yours and rolls over year-to-year. One major perk with the HSA? Freese and Nichols provides you with money every year to help you cover your deductible.

What is a Health Savings Account?

A Health Savings Account is a tax-exempt savings account that allows you to save money to pay for qualified medical expenses. The money in your HSA can be used to pay for qualified medical, dental, and vision costs such as deductibles and other out-of-pocket expenses. HSAs provide a triple-tax advantage – you can deposit money tax-free, it will grow tax-free until you use it, and your withdrawals are tax-free when used on eligible expenses.

Free Preventive Drugs for HDHP Members

If you enroll in the HDHP medical plan, there are certain preventive generic drugs that are covered at 100% and not subject to the deductible. Medications on this list include drugs in the categories of anticoagulants/antiplatelets, bowel preparation, breast cancer primary prevention, contraceptives, depression, diabetes medications, diabetic supplies, fluoride, high blood pressure, high cholesterol, osteoporosis, respiratory, tobacco cessation, and vaccines. If you use any of these preventative medications, enrolling in the HDHP can help save you money!

VIEW THE LIST

HSA Resources

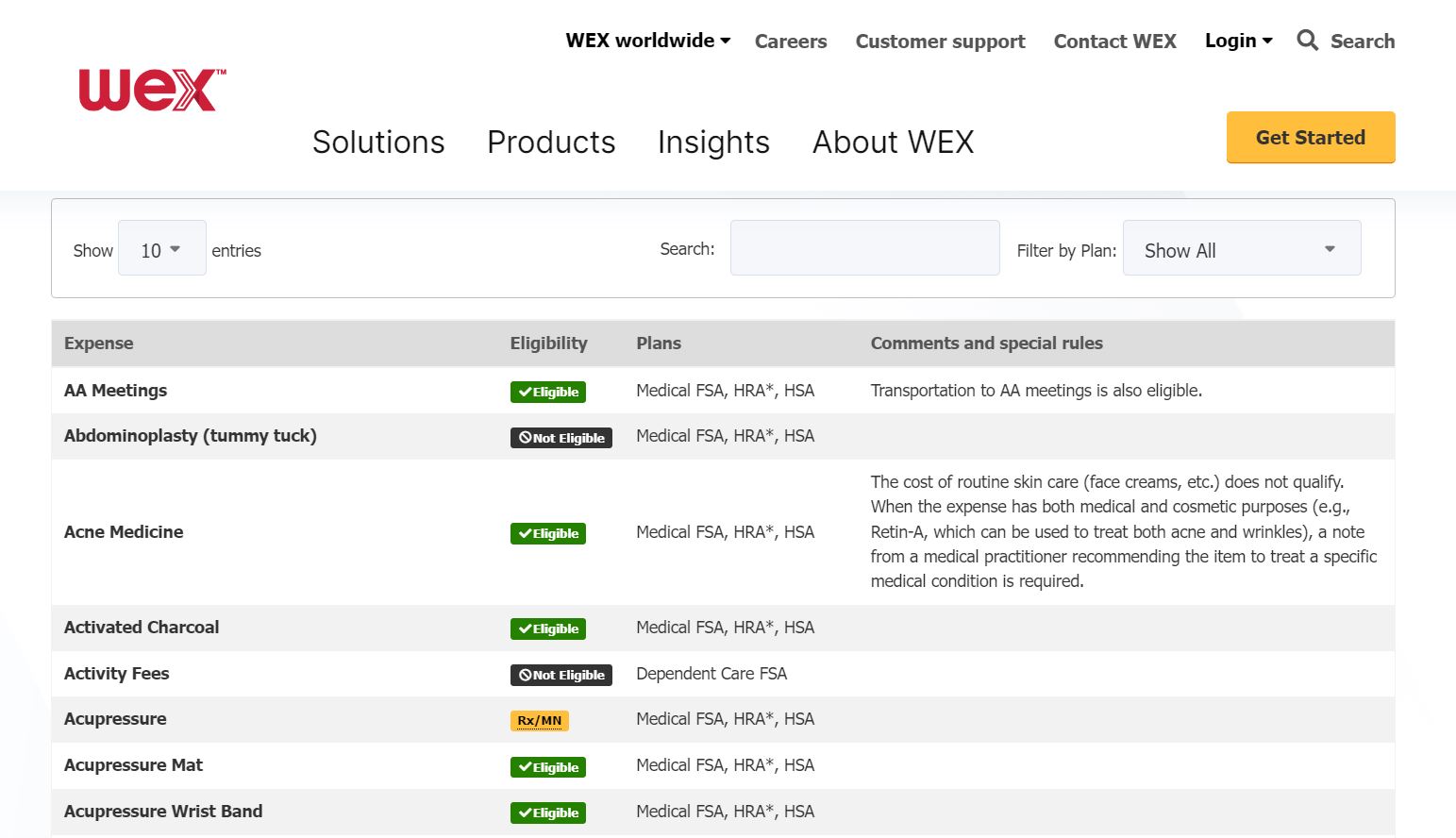

Flexible Spending Account (FSA)

What is a Flexible Spending Account?

A Flexible Spending Account (FSA) is a type of savings account that allows you to save money for specific, qualified expenses. These accounts have limits set by the IRS. Freese and Nichols offers a few different accounts that you may elect funds in:

- Healthcare FSA: covers health expenses such as prescription drugs, insurance copayments and deductibles and medical devices. This account can be partnered with the base PPO or buy up PPO plans.

- Limited Purpose FSA: covers qualifying dental, vision, and preventive care expenses and can be paired with a high-deductible health plan (HDHP) and a health savings account (HSA).

- Dependent Care FSA: helps participants save money on eligible dependent care services, such as child (up to age 13) or adult daycare, before or after school programs, summer day camp, and more! Freese and Nichols will contribute up to $1,000 to your Dependent Care account.*

*Prorated based on plan entry date.

CALCULATE HOW MUCH YOU WANT TO SET ASIDE

FSA Resources

Additional Elections

Additional elections include several benefits from Symetra, including Accident Insurance, Critical Illness Insurance, the Employee Assistance Program, Hospital Indemnity, and Life Insurance, as well as LegalShield, ID Shield and Nationwide Pet Insurance.

Benefits Support Services

Freese and Nichols offers support for navigating benefits through Marsh & McLennan Agency (MMA) Freese and Nichols Service Center. MMA is knowledgeable about our specific benefits plans and can help with major claims or simple questions. The online tool Nayya can also help you navigate the benefits decision-making process.

MMA Freese and Nichols Service Center

Contact MMA Freese and Nichols Service Center:

FreeseandNichols@marshmma.com

855-450-0194

PIN: 1791

What is the MyPerks App?

The MyPerks app is designed to help you navigate our benefit offerings and is personalized based on your enrollment. It also includes important company information. Discover all the beneficial information you need, when you need it, all in one place. It enables you to:

- View company benefits plans, resources and documentation on your phone

- Access carrier policy information

- Quickly contact a benefits carrier using the “Tap to Call” feature in the app

- Keep up to date with important company announcements with push notifications

- Participate in employer surveys

- Store images of ID cards

- Provide enrolled dependents access to the MyPerks app

How to Sign Up

Step 1: From the camera on your smartphone, scan the QR code.

Step 2: Follow the steps to complete the registration process.

Step 3: You will be prompted to download the app where you will enter your username and password that you just created.

What is HealthCheck360?

Freese and Nichols is partnering with HealthCheck360 to expand your employee benefits with a new wellness program. This wellness program is available to all employees eligible for the medical insurance plan in 2026. HealthCheck360 is devoted to improving your health and overall well-being by providing you with tools, motivation, and support to assist you in your journey to a healthier you.

You will receive a personalized, confidential report of your health status after your biometric screening.

Need help setting up your HealthCheck360 app? Email support@healthcheck360.com or call 866-511-0360.

How to Sign Up

Step One:

- Create your myHC360+ account by visiting the web page or downloading the mobile app

- Select ‘Register’ at the bottom of the page.

- Enter FRENI for your company code.

- Use the last four of your SSN for the Unique ID.

Step Two:

- Take the short Health Risk Assessment survey on your myHC360+ account by 11/21/25.

Step Three:

- Complete a Biometric Screening by 11/21/25.

- Schedule a visit with LabCorp walk-in clinic through the app OR

- With your physician using the HealthCheck360 physician form (downloadable through the app). Visits with a blood draw from 1/1/25 – 11/21/25 accepted.

Ready to enroll?

You can use SSO to sign into Workday to begin your enrollment. View this video to help with Open Enrollment steps in Workday:

ENROLL HEREQuestions?

If you have questions or need assistance, contact your Human Resources Business Partner or email OpenEnrollment@freese.com.