Learn more about the benefits options available to you at Freese and Nichols and the highlights of our 2024 plan.

About Benefits Enrollment

During your benefits enrollment in Workday, you may:

- Update your personal information in Workday

- Review your options

- Enroll in benefit elections

- Add dependents and beneficiaries

- Enroll in one of the Flexible Spending Account (FSA) options

- Start contributions to a Health Savings Account (HSA)

Highlights for 2024: Continuing to Keep Your Costs Low

While there are no major changes to the Freese and Nichols health and wellness plans this year, there are a couple of important highlights:

The cost for most of your insurance remains the same. We are excited to announce that your costs for the HDHP and the Base PPO plans will be lower in 2024!

Per IRS regulations, the individual deductible amount for the HDHP will increase slightly to $3,200.

Freese and Nichols employees will have access to two new enhancements: MyDiscounts and the MyPerks app. MyDiscounts connects employees with discounts on a wide variety of items including travel, food, and well-being. The MyPerks app will be a one-stop shop for employees to review and access their benefits information.

What's New

- Individual deductible amount will slightly increase for HDHP

- Rates will be reduced for the HDHP and the PPO plans

- Gain access to discounts with MyDiscounts, a new resource for employees discounts on everything from travel to well-being to food

- Stay more organized with the MyPerks app, a new resource for employees to manage all benefits information in one place

What's the Same

- BlueCross BlueShield will continue to provide our medical, dental, and vision coverage.

- Alight will still be your Healthcare Advocate.

- Unum will continue to provide many products to protect you financially: Life Insurance, Critical Illness and Accident Coverage.

- WEX will continue to manage your FSA/HSA accounts.

- After you have met the deductible on the HDHP, non-preventative expenses will still be covered by the plan at 100% in-network.

- Freese and Nichols will make up to a $1,000 contribution to your Dependent Care account.

- You will be given a password locker for you and your family through Keeper Security. This cyber security password locker can identify and protect against breach activity, theft, and sabotage.

Next Steps

- Consider enrolling in the added benefits Freese and Nichols provides, beyond your normal insurance options.

- Beginning October 30, all employees will need to make benefit elections in Workday.

- If you don’t complete open enrollment, most of your current health and insurance coverages will continue in 2024. However, your Flexible Spending Account (FSA), Dependent Care, and Health Savings Account (HSA) will not continue unless you re-enroll.

Medical, Dental, and Vision

While there are no major changes to the health and wellness plans this year, we are pleased to keep the costs of your insurance the same. Here are a few highlights and reminders:

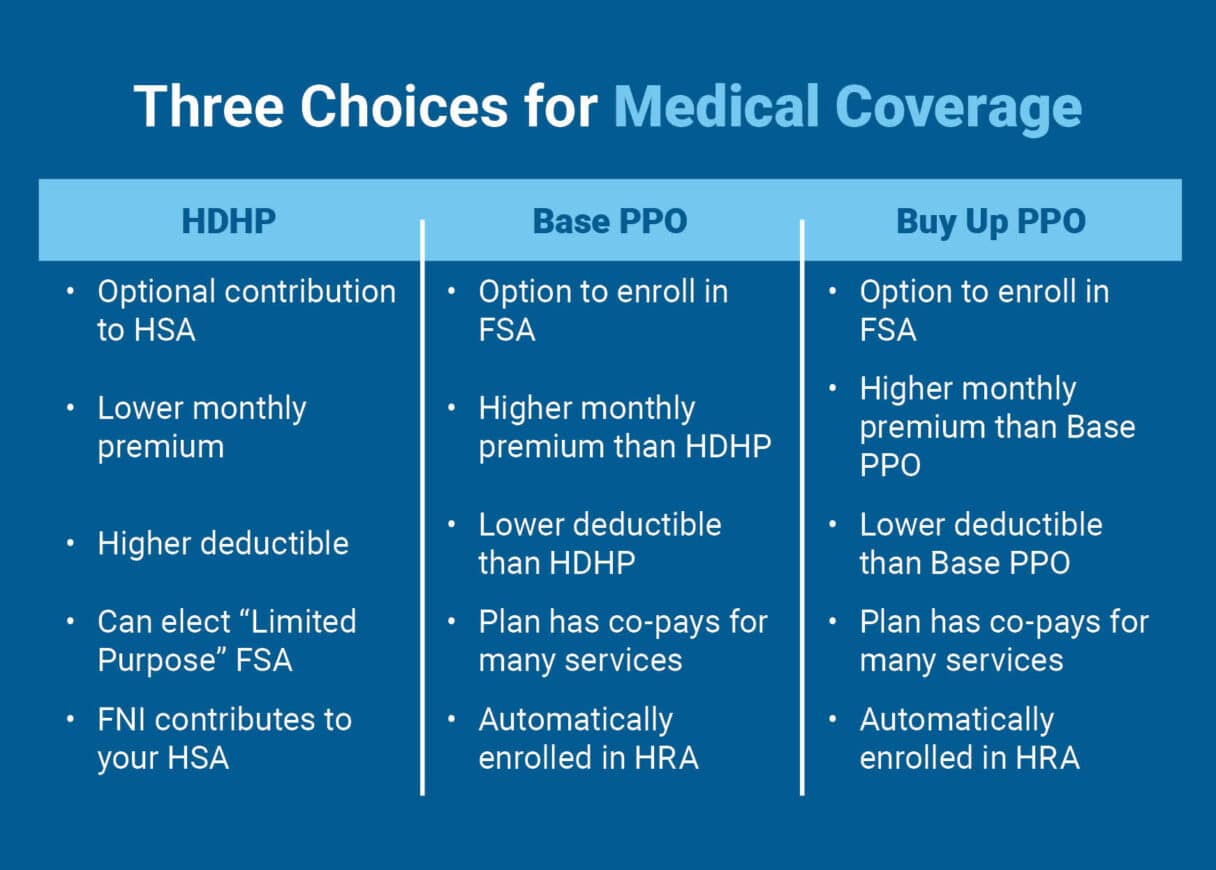

- We partner with Blue Cross Blue Shield (BCBS) to administrator our medical plans. You can choose between three medical plans options:

High Deductible Health Plan (HDHP) with Health Savings Account (HSA)

Base PPO with Health Reimbursement Account (HRA)

- After you have met your deductible on the HDHP, non-preventative expenses will be covered by the plan at 100% in-network.

- No changes for the Buy Up plan.

- No changes for the dental and vision plan design and options.

- Our comprehensive vision plan through Blue Cross Blue Shield of Texas is powered by EyeMed Vision Care.

Medical, Dental and Vision Resources

Here are a few resources for making the most of your plans. If you would like to talk through your options, call Blue Cross Blue Shield at 800-521-2227.

Find in-network medical doctors and facilities

Are your providers in the BCBS network? Click below to search the Blue Choice PPO network.

SEARCH BCBS NETWORKFind in-network vision providers

BCBS uses the EyeMed provider network. Click below to search for providers.

SEARCH EYEMED NETWORKMedical and Dental Mobile App

Download the BCBS mobile app for your smartphone and have your benefits with you wherever you go. You’ll have access to your digital ID cards with a tap of a finger.

DOWNLOAD BCBS APPHave You Thought About the High Deductible Health Plan (HDHP)?

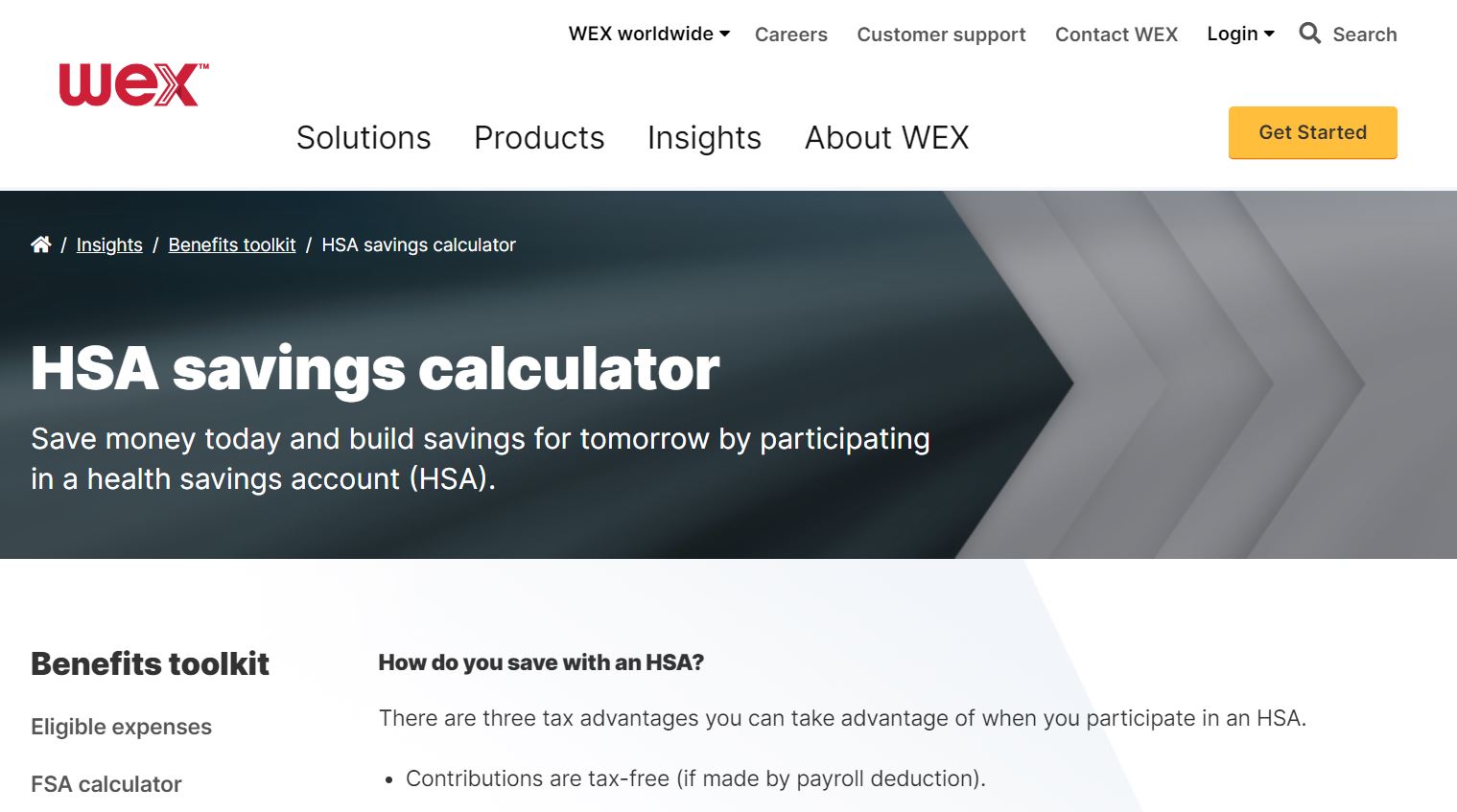

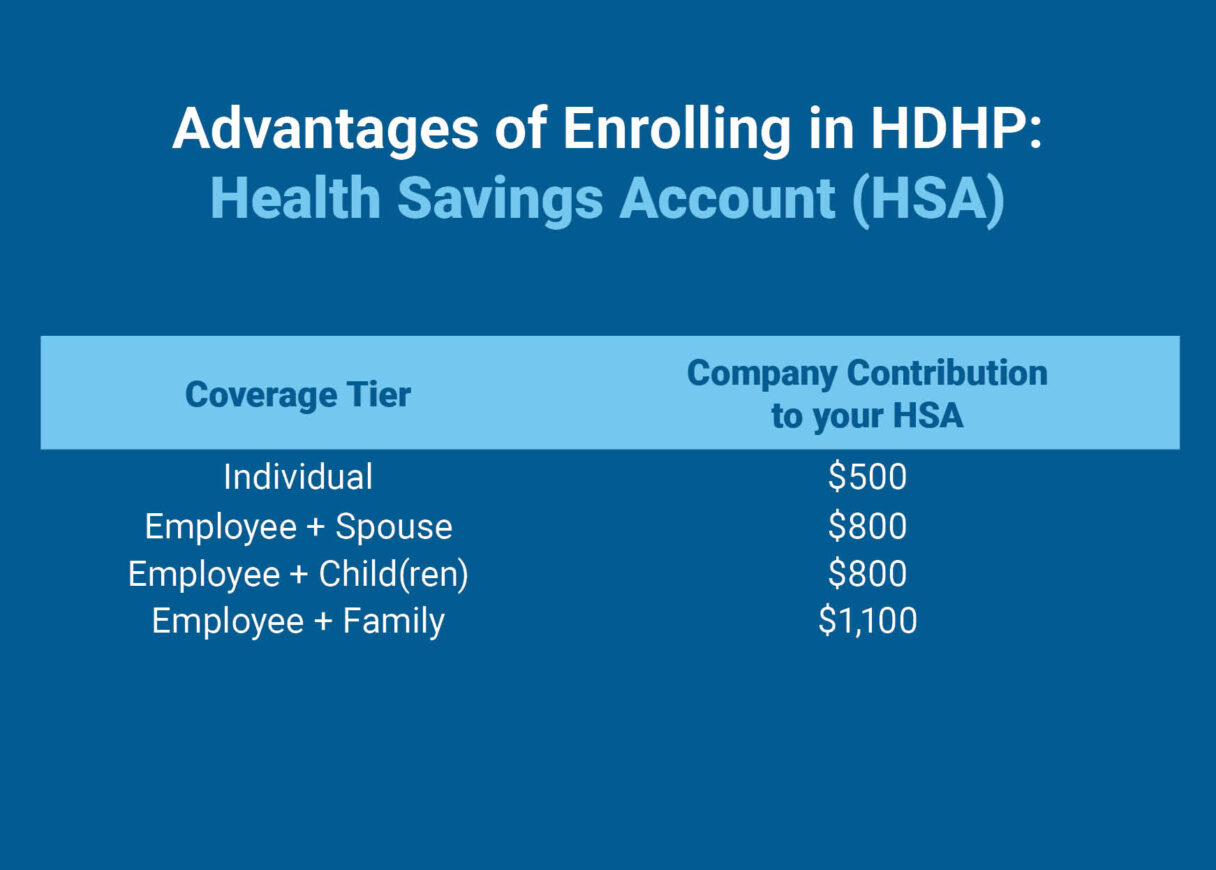

Don’t let the words “high deductible” scare you. This is a good time to understand how much you use the health plan — and consider when the last time was that you met your deductible. There are advantages of enrolling in the plan, including the Health Savings Account (HSA). This account is yours and rolls over year-to-year. One major perk with the HSA? Freese and Nichols provides you with money every year to help you cover your deductible.

HSA Resources

Free Preventive Drugs for HDHP Members

If you enroll in the HDHP medical plan, there are certain preventive generic drugs that are covered at 100% and not subject to the deductible. Medications on this list include drugs in the categories of anticoagulants/antiplatelets, bowel preparation, breast cancer primary prevention, contraceptives, depression, diabetes medications, diabetic supplies, fluoride, high blood pressure, high cholesterol, osteoporosis, respiratory, tobacco cessation, and vaccines. Another way enrolling in the HDHP can help save you money!

VIEW THE LIST

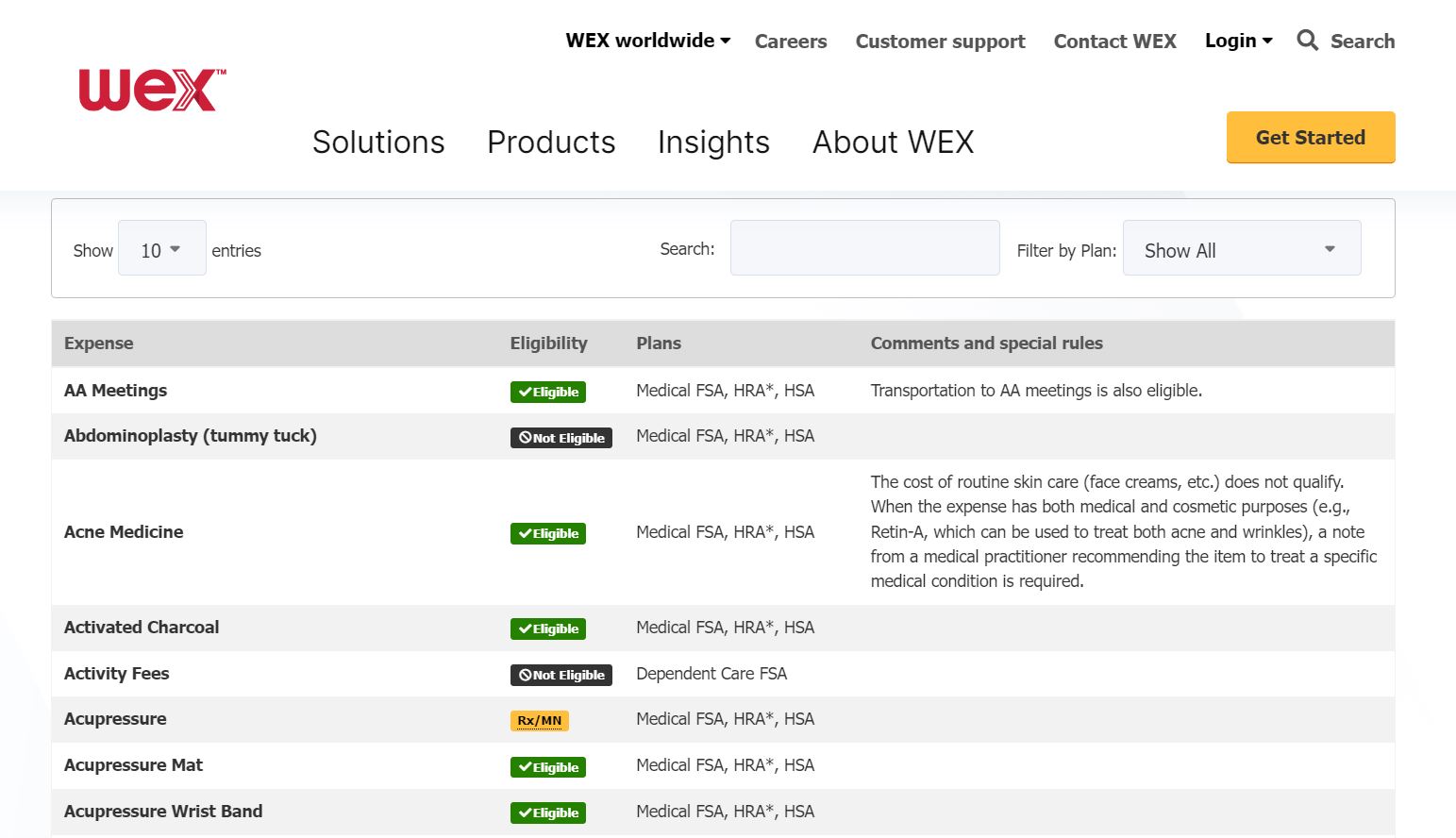

Flexible Spending Account (FSA)

A Flexible Savings Account (FSA) is a type of savings account that allows you to save money for specific, qualified expenses. These accounts have limits set by the IRS. Freese and Nichols offers a few different accounts that you may elect funds in:

- Healthcare FSA: covers health expenses such as prescription drugs, insurance copayments and deductibles and medical devices. This account can be partnered with the base PPO or buy up PPO plans.

- Limited Purpose FSA: covers qualifying dental, vision, and preventive care expenses and can be paired with a high-deductible health plan (HDHP) and a health savings account (HSA).

- Dependent Care FSA: helps participants save money on eligible dependent care services, such as child (up to age 13) or adult daycare, before or after school programs, summer day camp, and more! Freese and Nichols will contribute up to $1,000 to your Dependent Care account.*

*Prorated based on plan entry date.

CALCULATE HOW MUCH YOU WANT TO SET ASIDE

FSA Resources

Additional Elections

Additional elections include several benefits from Unum, including Critical Illness, Accident and Voluntary Term Life Insurance, as well as LegalShield, ID Shield and Pet Insurance from Nationwide.

Benefits Support Services

Freese and Nichols offers support for navigating benefits through Alight and Marsh & McLennan Agency (MMA) Freese and Nichols Service Center. Rely on Alight for understanding benefits, finding doctors, saving money on care and prescriptions, resolving billing errors and scheduling appointments. MMA is knowledgeable about our specific benefits plans and can help with major claims or simple questions.

Alight

Contact Alight:

New registrants use the last four of your Social Security number when prompted.

http://member.alight.com

MyHealthPro@alight.com

800-513-1667

MMA Freese and Nichols Service Center

Contact MMA Freese and Nichols Service Center:

FreeseandNichols@marshmma.com

855-450-0194

PIN: 1791

Ready to enroll?

You can use SSO to sign into Workday to begin your enrollment.

View this video to help with Open Enrollment steps in Workday:

Questions?

If you have questions or need assistance, contact your Human Resources Business Partner or email MyPerks@freese.com.