Flexible Spending Account (FSA)

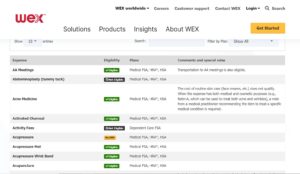

A Flexible Savings Account (FSA) is a type of savings account that allows you to save money for specific, qualified expenses. These accounts have limits set by the IRS. Freese and Nichols offers a few different accounts that you may elect funds in:

- Healthcare FSA: covers health expenses such as prescription drugs, insurance copayments and deductibles and medical devices. This account can be partnered with the base PPO or buy up PPO plans.

- Limited Purpose FSA: covers qualifying dental, vision, and preventive care expenses and can be paired with a high-deductible health plan (HDHP) and a health savings account (HSA).

- Dependent Care FSA: helps participants save money on eligible dependent care services, such as child (up to age 13) or adult daycare, before or after school programs, summer day camp, and more! Freese and Nichols will contribute up to $1,000 to your Dependent Care account.*

*Prorated based on plan entry date.

CALCULATE HOW MUCH YOU WANT TO SET ASIDE